Newsletter 2/2021

Business overview

In accordance with the statistics of the Office of Insurance Commission (OIC), the total non-life insurance premiums from January to March 2021 amounted to 64,571 MB, or 1.54% growth YoY, detail in Figure 1.

Source: OIC, Q1/2021 Summary of Non-life insurance business

Figure 1 Non-life insurance premium details by policy types

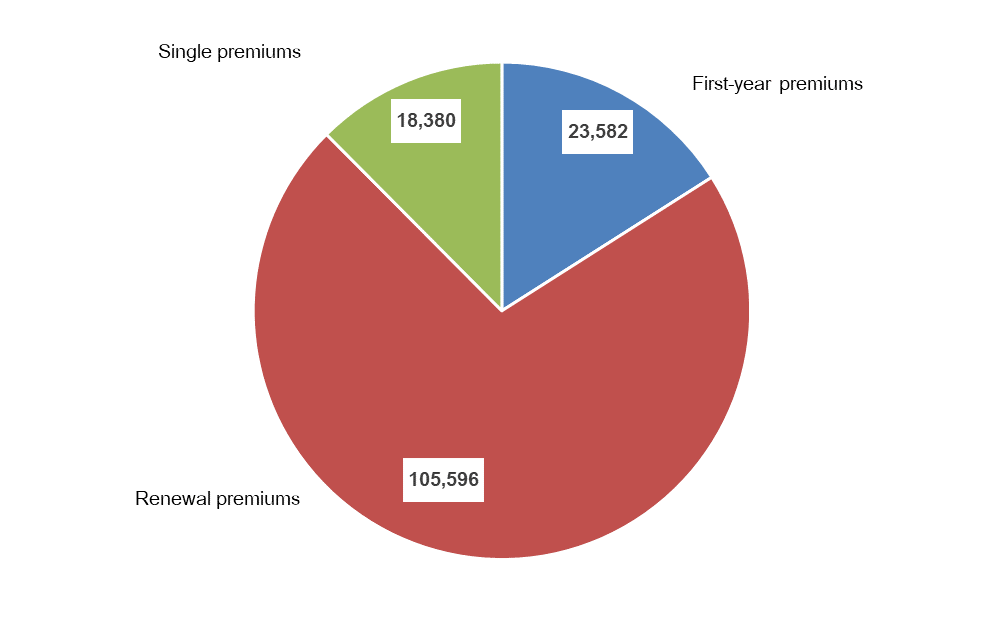

ife insurance premiums from January to March 2021 amounted to 147,558 MB, which were 23,582 MB from the first-year premiums; 105,596 MB from the renewal premiums; and 18,380 MB from single premiums as detailed in Figure 2.

Source: OIC, Q1/2021 Summary of Life insurance business

Figure 2 Life insurance premium details by premium types

In the second quarter of 2021, Thailand was still under Covid-19 virus pandemic and in severe conditions from variants of Coronavirus. However, as the virus spread, the people tended to have more concern about their health. As a result, sales of covid-19 related insurances and health insurances increased significantly.

The Company was always ready and had plans for crisis management. For instance, the Work From Home and online sales for new policy sales and product renewals of “Virus found, get paid” insurance package along with other insurance products. Despite the widespread impact of the pandemic, in this quarter the Company continued to grow as planned, from sales, cost control and efficient use of resources.

The Company considered the safety of employees and customers as priority as well as maintaining normal business operations. The Company therefore determined measures to prevent and control the spread of the virus in the Company’s facilities strictly aligning with the government’s standard and requirements. The Company also communicated to all employees to ensure proper understanding on the measures including collaborating with government agencies such as district offices and other agencies in planning for vaccines for employees. In addition, the Company as well prepared employees for the new working environment such as working from home for the best effective performances according to the Company’s goals.

Company Overview

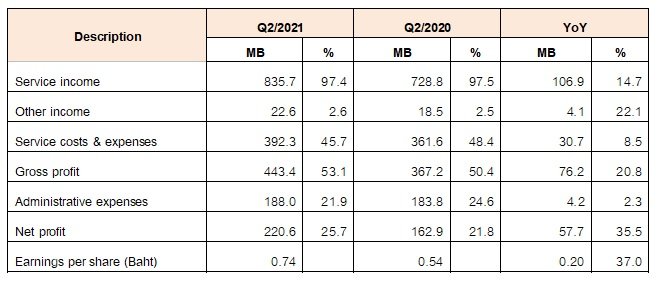

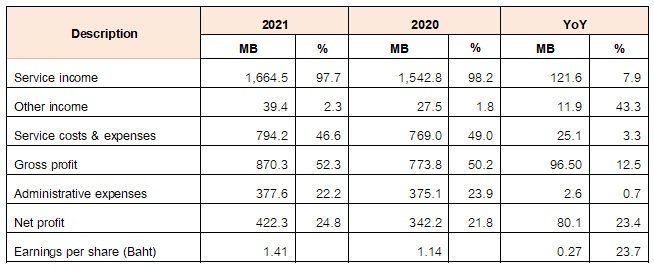

2-Quarter Company Overview

- Service income of Q2/2021 was 835.7 MB compared to 728.8 MB of Q2/2020, increased amounted to 106.9 MB or 14.7% YoY from the increase of sales and services of various insurance products and channels.

- Service cost and expenses of Q2/2021 was 392.3 MB or 45.7% of total revenues compared to 361.6 MB or 48.4% of Q2/2020, increased amounted to 30.7 MB or 8.5% YoY as the increase of sales.

- The gross margin of Q2/2021 was 443.4 MB or 53.1% compared to 367.2 MB or 50.4% of Q2/2020, increased amounted to 76.2 MB or 20.8% YoY from the expansion of sales channels, exclusively online.

- Administrative expenses of Q2/2021 was 188.0 MB or 21.9% compared to 183.8 MB or 24.6% of Q2/2020, increased amounted to 4.2 MB or 2.3% YoY. As the Covid-19 pandemic, the Company was aware of the importance of Company’s human resources; therefore, the Company arranged Covid-19 insurance to all employees as well as donating Automated External Defibrillator, funding foundations to help patients those in need, and offering Survival bags to communities; causing some extra administrative expenses.

- The net profit of the group for the operation results of Q2/2021 was 220.6 MB or 25.7% compared to the net profit amounted to 162.9 MB or 21.8% of Q2/2020, increased in amount of 57.7 MB or 35.5% YoY as result of the increase of sales from every channel and the best cost control.

- 2-Quarter Earnings per share was 1.41 baht per share, increased 0.27 baht per share, compared to 2-Quarter of the previous year or 23.7% and earnings per share of Q2/2021 was 0.74 baht per share, compared to 0.54 baht per share of Q2/2020, increased in amount of 0.20 baht per share. In addition, the Board of Directors meeting on 11 August 2021 has approved the interim dividend payment in amount of 1.45 baht per share. The record date (RD) shall be on 27 August 2021 and the payment shall be on 9 September 2021.